A Guide To Thresholds for Audited Accounts

The thresholds for audited accounts have been updated for 2025. Learn more about the new thresholds for micro, small and medium businesses.

By Morgan Davies

On 6 April 2025, new regulations on audited accounts took effect for micro, small and medium-sized entities. These changes saw an increase to the company size thresholds required for audited accounts for the financial year starting 6 April 2025.

Here, we look at what these changes mean for micro, small and medium sized businesses, and when audited accounts can provide additional benefits for your business.

For more information about audits, read our accounting and auditing FAQs or learn about our auditing services.

What is the threshold for audited accounts?

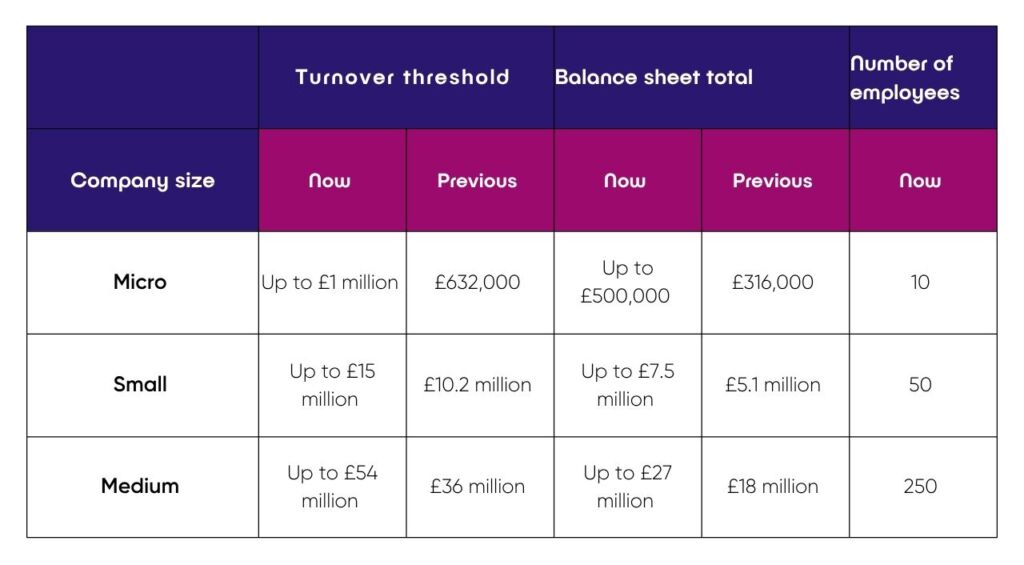

The table below details the changes to the thresholds for audited accounts for micro, small and medium companies.

These updates mean that micro and small businesses now have much lower reporting requirements. They do not need an audit, and the set of accounts they need preparing is much smaller and simpler.

Audits are significantly more complex and detailed than accounts work and the cost of an audit reflects this, so the smallest businesses will benefit from reduced compliance fees.

However, if you a company becomes medium-sized or larger, then it will need an audit if it is part of a group of companies, then those will also need to be consolidated for an audit.

What turnover is required for audited accounts?

Company size limits are met if any two of the following three thresholds are met.

What are the audit thresholds for Limited Liability Partnerships (LLPs)?

The increased audit thresholds outlined above also apply to Limited Liability Partnerships (LLPs).

LLPs can also apply the transitional provision for the application of the two-year rule.

What is the audit thresholds two-year rule?

A company's size is determined by either the results of its first financial year, or by its financial results for any two consecutive years.

For example, if a company reaches the small company size threshold in its first financial year, it will remain in that size category until it fails to meet the threshold limits for two consecutive years.

From 6 April 2025, companies can apply the new size thresholds retrospectively to the previous financial years. This change has been implemented to enable companies to immediately benefit from the higher thresholds without waiting for two full years under the new rules.

How will the new thresholds for audited accounts benefit businesses?

There are two main benefits for clients that no longer meet the medium-sized company threshold:

Reduced compliance costs

It is estimated that 14,000 companies previously classed as medium will now meet the threshold for small businesses and benefit from audit exemption. These businesses will benefit from an ease in reporting processes.

In addition, approximately 113,000 companies will fall under the micro entities threshold, enabling them to prepare and submit much simpler company accounts than required previously.

All of these businesses will benefit from a reduction in compliance costs.

Confidential accounts

A key benefit for companies that are not medium-sized, so micro and small entities, is that the accounts they file with Companies House do not need to include the profit and loss.

This means they can keep a lot of financial information confidential, which many clients and companies prefer.

The benefits of auditing accounts

There are numerous benefits to having audited accounts, even if your business is exempt.

An audit gives the owners of a company the confidence their accounts are correct, so even for businesses that do not meet the thresholds for an annual audit, it can be useful if they are thinking about selling the business at some point in the future.

It also gives more credibility to the company if you are planning to tender for public projects, as it provides transparency. For example, government bodies often like to see audited accounts as it provides added confidence they are dealing with a credible firm.

Also, if it is not an owner-managed business – where someone is an owner and somebody else runs the company on their behalf – from the owner's point of view, it is valuable to have an audit so they know the accounts are accurate and provide a true and fair view.

At Prime, our advice for businesses is to work out if it is worthwhile for you and your business.

There are certainly some circumstances where it absolutely will be worthwhile and some circumstances where it won't be, so do what's right for your company.

Learn more about the benefits of an audit for your business.

Why have the audit thresholds changed?

Changes to audit thresholds have been introduced to help cut complexity and reduce reporting burdens for micro and small businesses.

As the previous thresholds were set in 2013, they have also been updated to account for the impact of inflation on turnover and assets.

A guide to thresholds for audited accounts

As an audit specialist, I lead our expert accounting and auditing team, which carries out more than 200 audits each year for micro, small and medium sized businesses.

If you have a question about your business' auditing needs, please get in touch, or find out more about our corporate accountant services.

A Guide To Thresholds for Audited Accounts

If you have a question about audits, please get in touch, or find out more about our corporate accountant services.