News Centre

News articles, blogs and resources from Prime Accountants

Please see below for a range of useful blog posts, resources and latest news stories which may be of interest to you.

Director Steven Harcourt gives his advice on what to consider when buying a business and explains the financial due diligence required.

By Steve HarcourtPublished On: 12/02/2026Our director Jamie Skelding is marking a magnificent four decades in the job – a role he feared he would lose in the first year after “spectacularly” failing his accountancy exams.

By Prime AccountantsPublished On: 09/02/2026Payroll Senior Manager, Martin Farrell, takes a look at how the Employment Rights Act is set to change the way Statutory Sick Pay is managed, so you can stay compliant.

By Martin FarrellPublished On: 03/02/2026Small businesses in the West Midlands are being warned about a change to accounting rules which could force them to add leased assets to their balance sheet or risk failing to meet audit regulations.

By Viv ShadboltPublished On: 03/02/2026Director Jamie Skelding examines the recent changes to Companies House and what else is coming in the near future.

By Jamie SkeldingPublished On: 28/01/2026Our team of tax experts has grown again with the “flagship” appointment of head of private client, Andrew Cockman.

By Prime AccountantsPublished On: 22/01/2026Director Paul Guise explains how to grow a business and the key points to consider.

By Paul GuisePublished On: 02/01/2026Director Steven Harcourt gives his advice on what to consider when buying a business and explains the financial due diligence required.

By Steve HarcourtPublished On: 16/12/2025Our team brought festive cheer to the young patients at Birmingham Children’s Hospital by stepping into Santa’s Grotto.

By Prime AccountantsPublished On: 11/12/2025Morgan Davies and Stuart Gooderham sit down to discuss the key announcements from the 2025 Autumn Budget and explain how the changes could impact costs, growth plans and financial strategy for small and medium-sized businesses.

By Prime AccountantsPublished On: 28/11/2025Advice on how to reduce tax bill for self-employed people – find out which self employed business expenses to claim for in our guide.

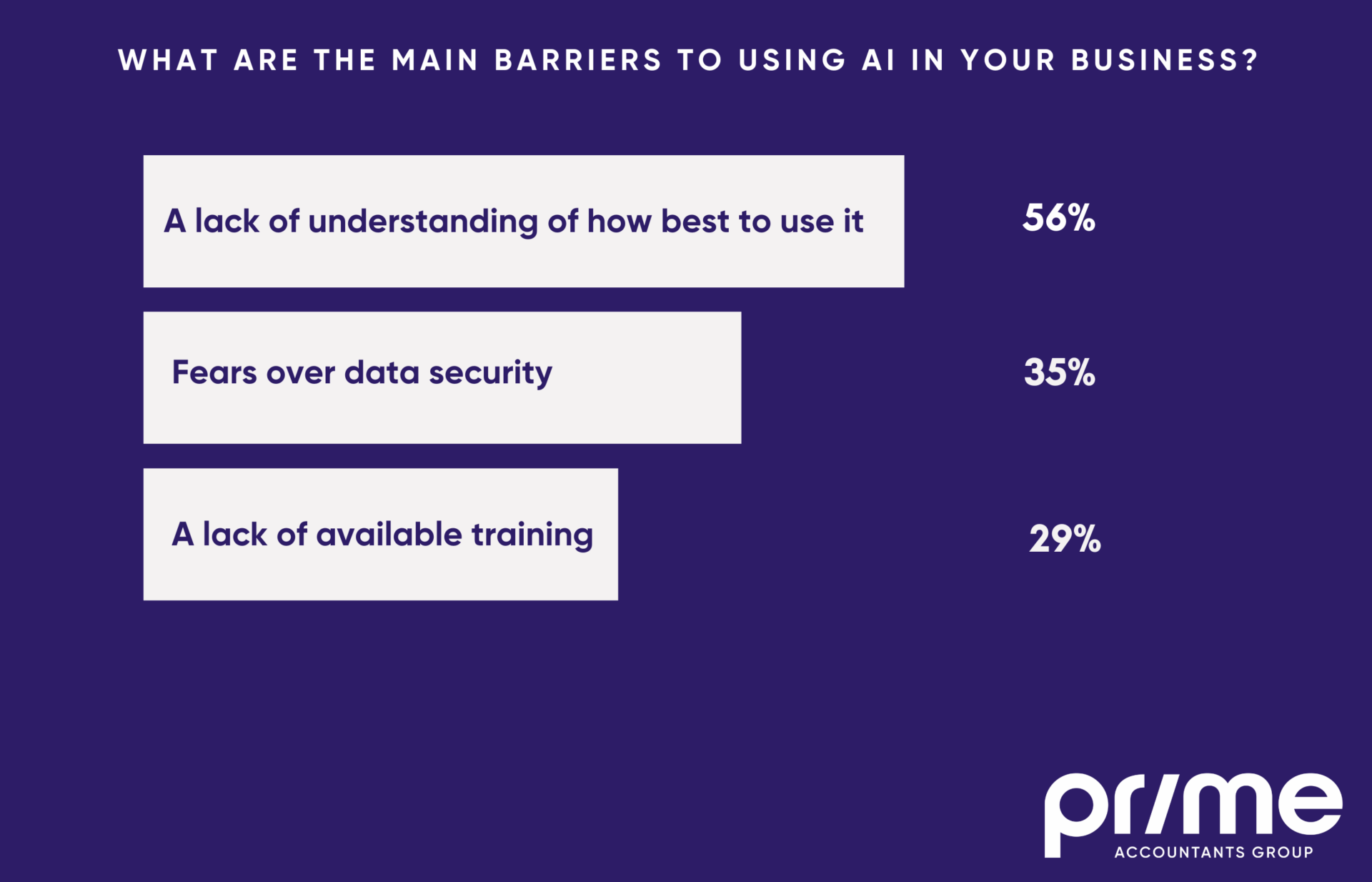

By Morgan DaviesPublished On: 28/11/2025A Prime Accountants survey has revealed more than half of Warwickshire businesses who responded have reservations around the use of AI in business.

By Morgan DaviesPublished On: 25/11/2025Director Steven Harcourt gives his accounting tips for small business owners to help make keeping on top of business finances simple.

By Steve HarcourtPublished On: 25/11/2025Find out the answers to the questions we are most frequently asked about gifting and inheritance tax.

By Paislei GodleyPublished On: 12/11/2025Director Stuart Gooderham brings two decades’ experience supporting private and owner-managed businesses to firm

By Prime AccountantsPublished On: 10/11/2025Prime Accountants Group has boosted its forensic accountancy offering with the appointment of Shannon Walden.

By Prime AccountantsPublished On: 26/10/2025Local lad Luke Edwards has marked his first year as a director at Prime Accountants Group’s Solihull office.

By Luke EdwardsPublished On: 17/10/2025If you’re looking for advice on family business succession planning, we’re here to help. Find out all more with our helpful guide.

By Kevin JohnsPublished On: 16/10/2025Viv Shadbolt brings more than 30 years’ accountancy experience in Birmingham to Prime Accountants Group.

By Viv ShadboltPublished On: 16/10/2025Find out the answers to ‘why is succession planning important?’, how to do succession planning, and other queries in our succession planning FAQs.

By Kevin JohnsPublished On: 03/10/2025This week marks National Payroll Week (September 1-5), an annual event dedicated to recognising and celebrating the crucial role that payroll professionals play in business.

By Martin FarrellPublished On: 01/09/2025What are the rules on tax on inherited property? Find out about inherited property and capital gains tax, plus inheritance tax and property, in our guide.

By Paislei GodleyPublished On: 26/08/2025Small businesses in Birmingham and Solihull are being encouraged to adopt the principles behind a new offence which will make firms legally responsible for preventing fraud within their own organisations.

By Prime AccountantsPublished On: 21/08/2025Clients who are business owners often ask questions beyond the typical scope of a financial advisor, as they’re in an isolated position at the top of their organisation.

By Prime AccountantsPublished On: 17/07/2025

Prime Accountants News Centre

Do you need to talk to us about any of the news, information or resources on our website?